Next Gen Real Investing Platform combined with an Innovative Construction Technology

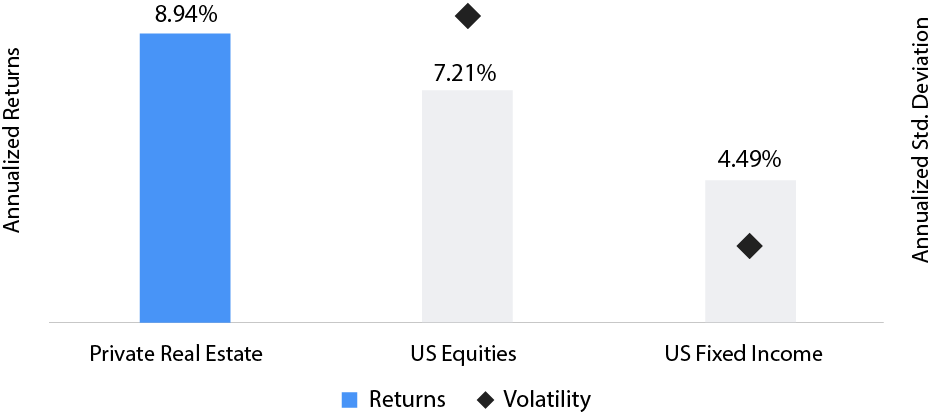

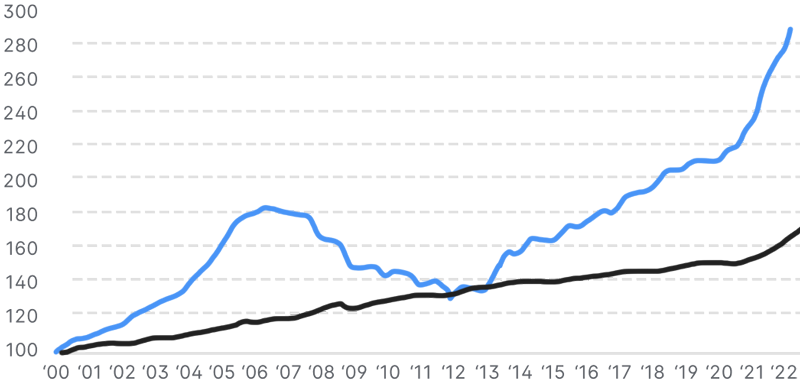

FundVate is a platform for forward-thinking investors to access private real estate. We empower individuals to build and protect wealth through rental cash flowand home value appreciation by investing in single-family rental homes. Our advantage lies in our association with Brickless Developers and their innovative construction technology. The Brickless monolithic concrete system allows for new homes to be built in just 15 days, all while ensuring they are hurricane proof, eco-friendly and future-ready.

FundVate identifies attractive markets with a growing population, strong economy, and a shortage of affordable housing. We then develop and subsequently lease new-construction single-family homes to individual renters, delivering a cash flowing, brand new product to FundVate investors.

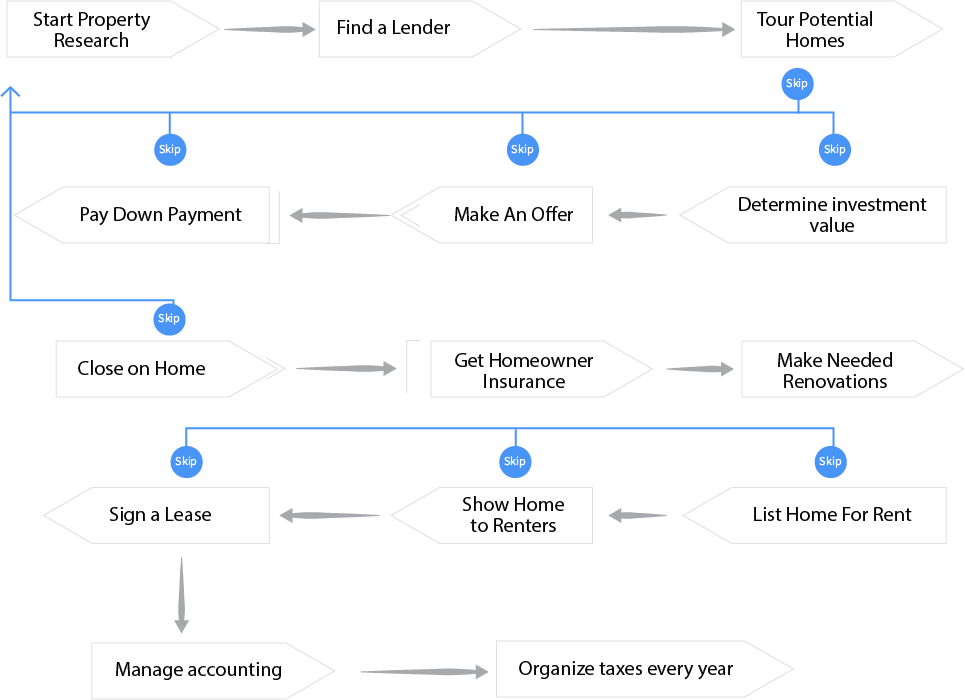

Experience the power of real estate investing without the need for a large capital investment or the hassle of property management. With a low minimum investment, you can start reaping the benefits of rental income and potential home value appreciation.

This is real estate investing made

Easy, Passive And Accessible